ohio hotel tax calculator

Alone that would place Ohio at the lower end of states with an income tax but many Ohio municipalities also charge income taxes some as high as 3. NA tax not levied on accommodations.

How To Calculate Credit Card Payment

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. Overview of Ohio Taxes. The calculator will show you the total sales tax amount as well as the county city and. Only In Your State.

So if the room costs 169. The state income tax system in Ohio is a progressive tax system. Divide tax percentage by 100.

After a few seconds you will be provided with a full breakdown of the. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Your average tax rate is 1198 and your marginal tax rate is 22.

This is now Chapter 703 of the Codified Ordinance. The price of the coffee maker is 70 and your state sales tax is 65. Ohio State Sales Tax.

Ad Finding hotel tax by state then manually filing is time consuming. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. Other local-level tax rates in the state of Ohio are quite complex.

HotelMotel Lodging Tax County Administration Building Room 603 138 East Court Street Cincinnati Ohio 45202. Maximum Possible Sales Tax. Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio.

Maximum Local Sales Tax. Depending on local municipalities the total tax rate can be as high as 8. Average Local State Sales Tax.

Ohio Property Tax Calculator. If you make 70000 a year living in the region of Ohio USA you will be taxed 10957. The Ohio Revised Code permits local governments to levy a tax on lodging furnished to transient guests by hotels and motels within that local jurisdiction.

Rates range from 0 to 399. 1 State lodging tax rate raised to 50 in mountain lakes area. Forms The collection of Lucas County HotelMotel lodging tax as permitted by Chapter 5739 of the Ohio Revised Code is coordinated by the Office of Management and BudgetThe local rule.

You can use our Ohio Sales Tax Calculator to look up sales tax rates in Ohio by address zip code. 65 100 0065. Municipalities or townships may levy.

Avalara automates lodging sales and use tax compliance for your hospitality business. Multiply price by decimal. Ohio Property Tax Rates.

Property tax rates in Ohio are higher than the national average which is currently 107. Ad Finding hotel tax by state then manually filing is time consuming. No additional local tax on accommodations.

The tax rate was increased to 4 effective. Other agencies churches social groups Ohio schools Ohio. The City of Troy collects the Hotel Motel Transient Occupancy Tax which was enacted by City Council Ord.

Avalara automates lodging sales and use tax compliance for your hospitality business. The Ohio OH state sales tax rate is currently 575. List price is 90 and tax percentage is 65.

Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. Ohio has a progressive income tax system with six tax brackets. Ohio Income Tax Calculator 2021.

Ohio Hourly Paycheck Calculator. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets.

How To Estimate Your 2021 Tax Refund Tips Calculators And More Cnet

Ohio Sales Tax Small Business Guide Truic

Monroe 8145x 14 Digit Heavy Duty Printing Calculator Monroe Systems

Monroe 8145x 14 Digit Heavy Duty Printing Calculator Monroe Systems

How To Calculate Wages 14 Steps With Pictures Wikihow

Monroe 8145x 14 Digit Heavy Duty Printing Calculator Monroe Systems

Income Ohio Residency And Residency Credits Department Of Taxation

Sale Vintage The Red W Booklet Advertising Pocket Calculator Etsy Pocket Calculators Booklet Vintage Advertisements

How To Get A Tax Clearance Certificate 50 State Guide Nolo

Taxes On Stocks How Do They Work Forbes Advisor

Indiana Sales Tax Common And Unusual Exemptions

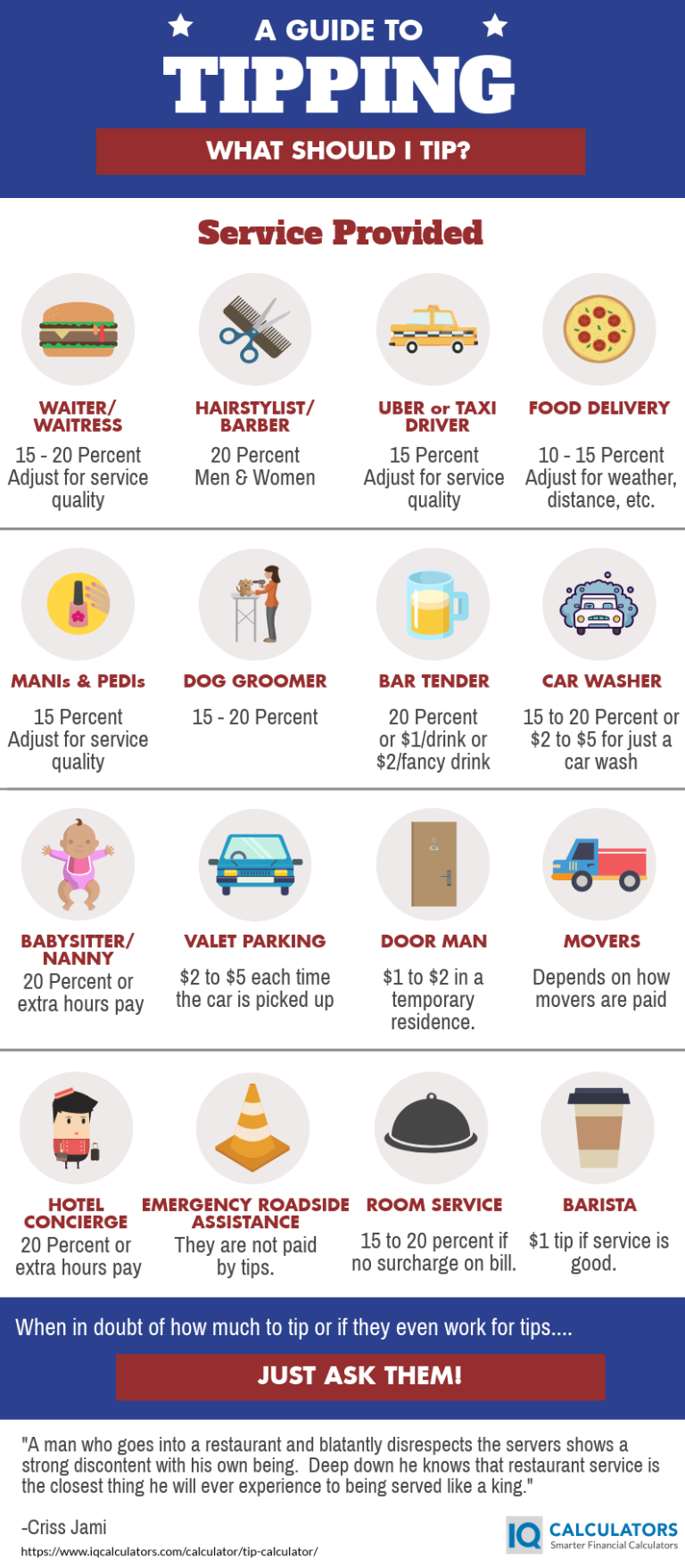

Tip Calculator Free Tip Calculator App

Ohio Offers Covid 19 Relief With Four Grant Programs

Utah Sales Tax Calculator Reverse Sales Dremployee

Calculating Payroll For Employees Everything Employers Need To Know

Prorated Rent Calculator How To Prorate Rent